Our Services

What We Do Best

Charter Finance Wholeness Journey offers an experience to clients where the only action required from them is to engage one service provider.

Instead of searching multiple lenders, financial planners, insurance and property experts, our clients can find all they need under one umbrella – one stop shop!

We are far ahead of your standard brokerage firm. At Charter Finance you will learn how to pay off your mortgage from 30 to 10 years and also learn how to take control of negative financial habits.

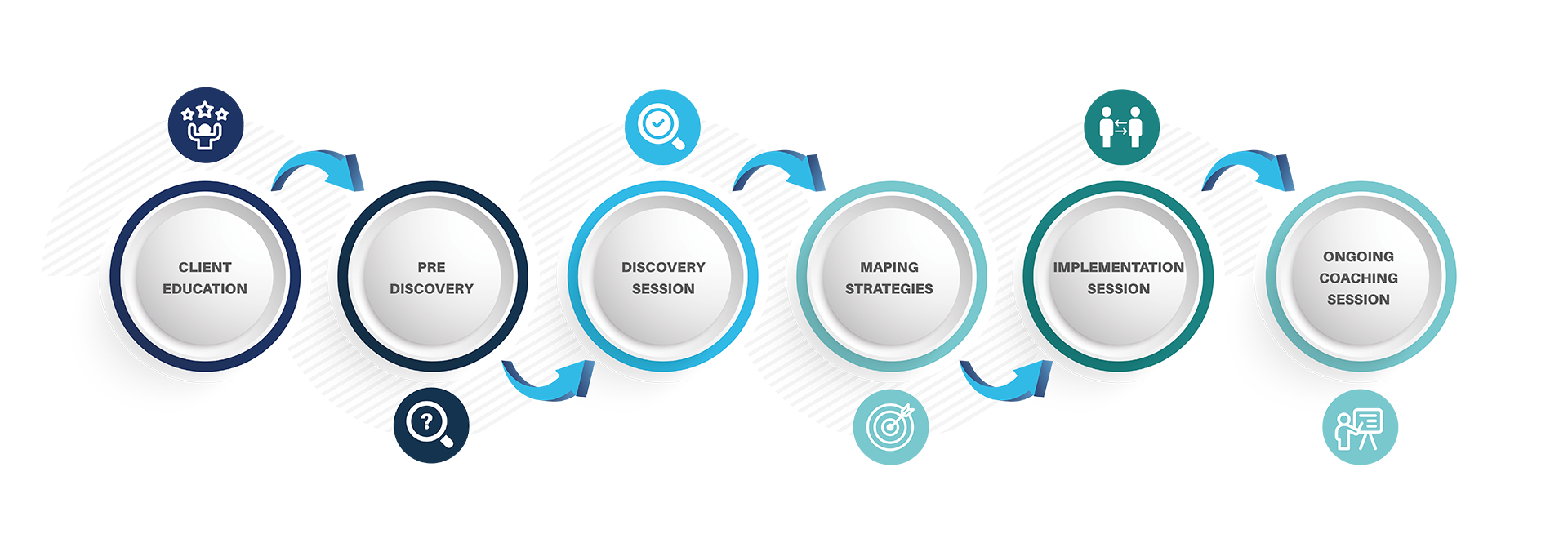

Our Process

In a world filled with opportunities and challenges, success often hinges on our ability to navigate the journey effectively. At Charter Finance, we understand that success is not a matter of luck, but rather a carefully orchestrated series of steps.

Join us as we embark on this transformative Financial Wholeness Journey together, where each step you take brings you closer to the achievements you aspire to.

Here is where our Journey starts: