There is some usual finger pointing (in our view unfairly so) going on now (always easy in hindsight) in that the Government hand-outs and Reserve Bank actions did too much by providing such cheap money as well as their aggressive bond buying. That our economy, as a whole, is in such an impressive state, deserves a stand-up ovation. There are always repercussions, and a heated property market, albeit very frustrating and challenging for those missing out (as we have many of our clients and potential clients in that bucket), is a price many would have likely still agreed to 1 year ago when the worlds economies were falling apart.

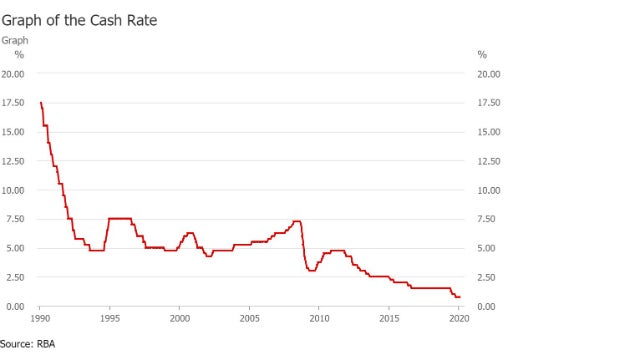

Fixed markets are now predicting an interest rate increase next year and there has been much said recently about the ever-increasing property market as a result of the very cheap debt that’s available. There are those calling on the Reserve Bank to increase rates sooner rather than later, but with the Reserve Bank governor having repeatedly said that cash rate will remain static for next few years, and many people borrowing on the basis that it will remain this low, has placed them in to a pickle jar.

The RBA has advised that their preferred medium to cool the property market, is to get APRA involved in the event lending standards go astray, as they did in 2014 (where APRRA put in measures which lasted 3 years). However lending standards are currently very stringent, and the banks are largely following every line in the book to ensure people are only borrowing what they can afford – so this escape clause may not work for the RBA in cooling the market. If they implement steps such as requiring greater deposits, they also then harm a segment of the market they want to support, being first home buyers etc.

As a credit advisory, our focus for all of our clients is to ensure that they are using debt to grow their wealth, but have full control over the level of debt that they have or are planning on taking on. We provide our clients with many strategies as to how to repay their debt quicker and also utilise their equity to grow their asset base, be it their choice of property, their business or shares. The key is whilst rates are so low, to make the debt work for you as opposed you working to pay off the debt.

Given all the current chatter around increases to the cash rate, we are therefore recommending clients (subject to any advice from your advisers/accountants) seriously consider the following:

- Locking / fixing in a level of their debt;

- Repay as much extra into their (non-deductible) mortgage now:

- These funds can be used towards a future property purchase or for when rates do increase, this serves as a healthy buffer to fund any additional outflows

- Refinance, and have the savings we can likely create for you, go directly into your new mortgage, whilst you retain the same level of payments you are currently on.

At some point in time, rates will increase, so our view is always, calculate now what an extra 0.50% would be to your mortgage (or call us and we can go through this with you), whatever that amount is, plough it into your mortgage (or offset account) now and have these savings benefit you, as supposed to having it go direct into your banks pocket for when those increased rates do arrive.

It is important to know that each borrower’s individual circumstances will be different and fixing may be a good option for some, but not others.