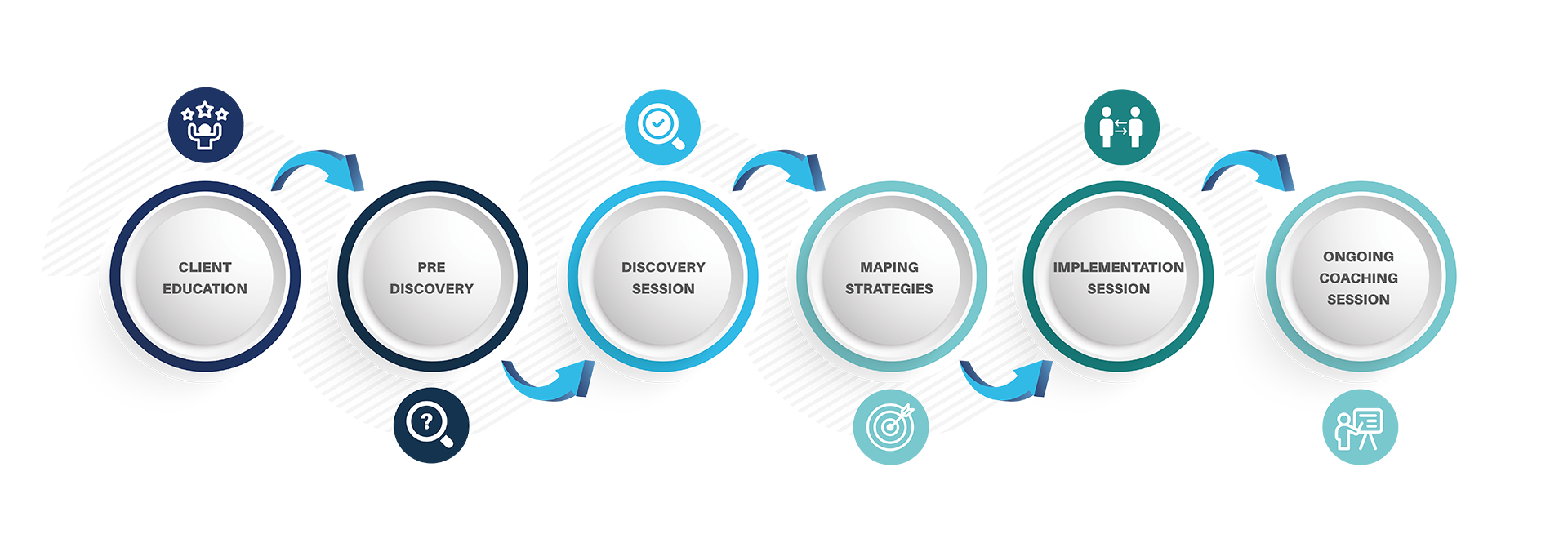

Charter Finance Wholeness Journey offers an experience to clients where the only action required from them is to engage one service provider.

Instead of searching multiple lenders, financial planners, insurance and property experts, our clients can find all they need under one umbrella – one stop shop!

We are far ahead of your standard brokerage firm. At Charter Finance, you will learn how to pay off your mortgage before 30 years and also learn how to take control of negative financial habits.

If you’re ready to take control of your financial future, contact our team today.